Happy 4th of July C-store operators! Let’s talk about staying ahead of the curve. Every day brings new challenges and opportunities in our fast-paced industry, and Thursday, July 3rd, was no exception. From how big players like Starbucks are rethinking their spaces to the subtle ways Gen Z interacts with brands, and crucial strategies for boosting your foodservice margins and tackling those pesky operating expenses, there’s a lot to unpack.

This isn’t just about reading the news; it’s about translating it into a playbook for your business. We are diving into five key developments from this week that can directly impact your bottom line, enhance your customer experience, and keep your store thriving. Let’s get to it!

1. The Starbucks Effect: Redefining the C-Store Experience

Starbucks is making a significant move to redefine its physical stores, focusing on creating a “third place”, a comfortable, inviting space between home and work. Their new design emphasizes expanded seating, more power outlets, an improved ambiance, and dedicated mobile pickup areas to encourage customers to stay longer, work remotely, socialize, and relax. This initiative is part of CEO Brian Niccol’s “Back to Starbucks” plan, which involves shifting away from frequent discounts to highlight coffee quality and community.

Why it matters to C-stores: For years, convenience stores have been synonymous with “grab-and-go.” However, consumer expectations are evolving rapidly. Starbucks, a leader in quick-service beverages, is investing heavily in encouraging customer dwell time and enhancing the experience within their stores. This strategic shift is not merely about coffee; it represents a broader retail trend. When a quick-service giant recognizes and invests in the value of allowing customers to linger, it signals a fundamental change in what “convenience” truly means. It is no longer solely about speed; it is increasingly about providing a comfortable, efficient, and pleasant environment, even for a brief stop. This evolving definition of convenience creates a significant opportunity for C-stores to differentiate themselves, increase average basket sizes, and build stronger, more enduring customer loyalty.

Deeper Analysis: The explicit goal of Starbucks to revive the “third place” concept demonstrates a recognition that this idea is expanding beyond traditional coffee shops. Historically, the “third place” was Starbucks’ unique selling proposition. However, the modern consumer’s lifestyle often blurs the lines between work, leisure, and daily errands. This means individuals are actively seeking comfort and functionality in a wider variety of locations throughout their day. If a convenience store can offer even a scaled-down version of this “third place”, perhaps a clean restroom, a few comfortable seats, reliable Wi-Fi, and easily accessible charging ports, it can effectively capture customers who might otherwise opt for a coffee shop or even a fast-casual restaurant for a quick break or to handle some remote work. This strategic offering has the potential to increase impulse purchases and encourage repeat visits that extend beyond just a fuel-up or a quick snack run.

Furthermore, Starbucks’ strategic move away from discounts to emphasize coffee quality and community highlights a significant shift from price-driven competition to value-driven experience. The brand’s desire for customers to feel their visit was “time well spent” indicates that the overall quality of the in-store experience is becoming paramount. For C-stores, which often compete primarily on price and speed, this trend suggests that investing in the quality of the customer’s visit, from the pristine cleanliness of the store and the genuine friendliness of the staff to the inviting overall ambiance, can establish a more sustainable competitive advantage. A pleasant and welcoming environment naturally encourages customers to browse longer, discover new items they might not have initially sought, and ultimately spend more, thereby boosting the average transaction value and fostering long-term customer loyalty.

What You Should Be Doing:

- Evaluate your current space: Look for opportunities to add a few comfortable seating options, even if it’s just a small corner. Consider a high-top counter with stools if space is limited.

- Boost digital amenities: Ensure you have reliable, free Wi-Fi and easily accessible power outlets. Promote these amenities clearly, perhaps with signage near seating areas.

- Enhance ambiance: Focus on maintaining exceptional cleanliness, ensuring good lighting, and cultivating a pleasant atmosphere. Small touches like appropriate background music or visually appealing product displays can significantly improve the customer experience.

- Optimize mobile pickup: If your store offers mobile ordering, ensure your pickup area is clearly marked, efficient, and well-organized, similar to Starbucks’ new risers and shelves designed for better distinction and flow.

- Showcase your offerings: Take a cue from Starbucks’ abundant food displays. Make your fresh food and beverage options visually appealing and easily accessible to encourage impulse purchases and highlight your quality.

More Information: Restaurant Business Online.

2. Cracking the Gen Z Code: Engaging the “Dark Social” Generation

Gen Z has a unique digital behavior often referred to as “dark social”, a preference for private sharing via messaging apps rather than public social media posts. This generation is highly digitally fluent, values authenticity above all else, demands personalization and interactivity in their brand engagements, and expects brands to demonstrate genuine social responsibility. They are inherently skeptical of traditional marketing tactics and possess a keen ability to detect inauthenticity.

Why it matters to C-stores: Gen Z represents a massive and continuously growing consumer segment, wielding substantial purchasing power. Their distinct digital habits and evolving brand expectations render traditional advertising methods less effective. To successfully capture and retain this influential demographic, C-stores must shift their approach from merely broadcasting messages to actively fostering genuine connections, engaging in authentic two-way conversations, and consistently demonstrating their values through tangible actions. Ignoring the prevalence of “dark social” means missing out on what is arguably the most influential form of word-of-mouth marketing for this generation.

Deeper Analysis: Gen Z’s preference for private sharing is rooted in their desire for authentic self-expression and the pursuit of meaningful connections, free from the pressures of public performance that often characterize traditional social media platforms. Brands that have successfully engaged this demographic, such as Liquid Death and Duolingo, achieve this by embracing humor, satire, and unpredictability, which makes their brands feel more “human” and relatable. For convenience stores, this implies that the brand voice needs to be genuine and approachable, rather than overly corporate or polished. Instead of solely focusing on pushing sales messages, C-stores should prioritize sharing authentic stories, offering glimpses behind the scenes of their operations, or even creating lighthearted content that resonates with local interests and community spirit. This approach builds trust and naturally encourages private sharing, which is where Gen Z’s true influence and peer-to-peer recommendations primarily reside. A friendly, consistent, and authentic in-store experience further reinforces this digital brand personality.

Furthermore, Gen Z actively seeks to be part of the conversation rather than passive consumers of content. The success of brands like Chipotle, which leverages personalized menu hacks and viral TikTok challenges, illustrates how involving customers in the brand experience can forge a deeper emotional connection and a sense of ownership. Convenience stores can effectively leverage this by creating interactive experiences, both within the store and across their digital platforms. This could be as straightforward as inviting customers to participate in polls to vote on new snack flavors, encouraging them to share their favorite coffee customizations, or engaging them in local community events. Loyalty programs designed to offer personalized rewards and unique experiences, rather than just generic discounts, will resonate far more deeply with this generation and cultivate lasting engagement.

What You Should Be Doing:

- Be authentic and transparent: Don’t try to adopt a persona that isn’t true to your store. Allow your store’s unique personality to shine through. Share genuine stories about your staff, your involvement in the local community, or even the process behind preparing your fresh food offerings.

- Embrace digital fluency: Understand how Gen Z actively uses platforms like TikTok, Instagram Stories, and private messaging. Your digital content should be mobile-friendly, highly visual, and easily digestible or “snackable”.

- Foster interactivity: Actively run polls, ask engaging questions, or create simple challenges on your social media platforms that encourage user-generated content. Consider featuring a “customer’s favorite” spotlight for popular products or new arrivals.

- Personalize experiences: Utilize data from your Point of Sale (POS) system or loyalty program to offer personalized promotions, product recommendations, or to acknowledge customer milestones, which can significantly enhance their perception of value.

- Show don’t just tell, your values: If your store supports a local charity, implements sustainable practices, or engages in community initiatives, actively highlight these actions. Gen Z demands tangible proof of social responsibility from the brands they support.

More information: Ad Week.

3. Mastering Your Margins: Foodservice Profit Strategies

Foodservice represents a high-potential category for convenience stores, yet it frequently experiences “margin leakage.” Quick-service restaurants (QSRs) typically report net margins of 64%, while C-stores often see margins closer to 35%. This significant disparity is influenced by several factors, including sourcing practices (where middle players can add markups), a predominant reliance on pre-cooked or heat-and-eat models, a general lack of strict portion control, and specific ingredient quality choices. Effective strategies for improvement encompass cutting costs (through optimized inventory, waste reduction, theft prevention, and direct sourcing), strategically increasing prices, and actively driving sales volume.

Why it matters to C-stores: Foodservice is a critical engine for growth within the convenience store sector, offering significantly higher margins compared to traditional packaged goods. However, if not managed with precision and efficiency, these potential profits can easily diminish. Understanding precisely where these “leaks” occur and implementing targeted strategies can dramatically boost your overall profitability, transforming your foodservice program from a break-even operation into a true competitive advantage.

Deeper Analysis: The substantial 29-percentage-point difference in net margins between QSRs and C-stores is not merely a reflection of different product offerings; it is fundamentally linked to contrasting operational models. QSRs often prepare food from raw ingredients and maintain strict portion control, frequently sourcing directly from suppliers. In contrast, many C-stores rely heavily on a “heat-and-eat assemble model,” where ingredients arrive pre-sliced, pre-cooked, and pre-breaded, leading to higher initial costs. Additionally, C-stores often operate with a “free-for-all business” approach regarding condiment bars and toppings, which contributes significantly to increased food costs due to a lack of portion control. This reveals that simply altering menu items will not resolve the underlying margin issue. Convenience stores need to critically re-evaluate their fundamental operational processes for foodservice. While adopting a full QSR model might not be feasible for every C-store due to potential increases in labor costs, identifying and addressing specific areas such as portion control, optimizing supplier relationships, and making smarter ingredient choices can yield substantial improvements without necessitating a complete operational overhaul.

A closer examination of operational details reveals that even seemingly minor adjustments can lead to significant financial gains. The example of American cheese illustrates this point effectively. Its lower melting point means it can be added to a breakfast sandwich without requiring additional oven time, thereby saving labor. Its higher moisture content helps keep bread and other components softer for longer, potentially extending shelf life. Furthermore, it is typically less expensive than cheddar and shipped in convenient institutional packaging. This seemingly small ingredient choice impacts labor efficiency, product longevity, and direct cost. Similarly, optimizing inventory management to reduce spoilage and minimize stockouts, along with comprehensive staff training focused on waste reduction and theft prevention, are presented as crucial levers for cutting costs. These examples demonstrate that C-store operators do not need to implement drastic changes to see positive results. Concentrating on granular details like precise portioning, cultivating stronger supplier relationships, and making informed ingredient selections can cumulatively result in substantial margin improvements. Empowering staff with proper training in food handling and waste reduction transforms them into active participants in protecting and enhancing the store’s profitability.

Foodservice Margin Comparison: QSR vs. C-Store Key Differences

- Net Margins: QSRs typically achieve 64%, while C-Stores are closer to 35%.

- Operational Model: QSRs often cook from raw ingredients, whereas C-Stores primarily use a “heat-and-eat” assembly model.

- Portion Control: QSRs maintain strict portion control, while C-Stores often have a “free-for-all” approach, especially with condiment bars.

- Sourcing: QSRs tend to source more directly, while C-Stores often use middle players, leading to double markups.

- Ingredient Cost: Ingredient costs are optimized for scratch cooking in QSRs, but higher for pre-processed items in C-Stores.

- Labor Impact: QSRs generally have higher labor costs for scratch preparation, while C-Stores have lower labor for assembly.

- Key Leakage Areas: For C-Stores, key leakage areas include Gross Margin, Known/Unknown Loss, Supplies, and Portion Control.

What You Should Be Doing:

- Audit your foodservice costs: Conduct a thorough review of your current food costs, including ingredients, waste, and supplies, to identify specific areas of leakage.

- Implement strict portion control: For items like roller grill toppings, sandwich condiments, and coffee add-ins, establish clear portion guidelines and train staff to adhere to them. This can significantly reduce waste.

- Re-evaluate sourcing strategies: Explore options for direct sourcing, especially for high-volume items like produce, to eliminate unnecessary markups from intermediaries.

- Optimize inventory management: Utilize your POS system to track sales trends and inventory levels in real-time. This helps reduce spoilage, minimize stockouts, and improve product turnover.

- Invest in staff training: Provide comprehensive training on proper food handling, waste reduction techniques (e.g., proper rotation of stock), and theft prevention. Empowering your team can lead to significant cost savings.

- Consider ingredient alternatives: Evaluate if less premium, yet still high-quality, ingredients can be used in certain applications without compromising the overall customer experience, similar to the American cheese example.

More Information: At Your Convenience Podcast.

4. Elevating Your Foodservice: The Burger Blueprint

The article highlights McDonald’s successful upgrade of their McDouble into “The Daily Double” as a prime example of enhancing an existing menu item. This involved adding fresh ingredients like shredded lettuce and tomato, along with mayonnaise, to an already popular burger. The success of this enhanced burger in key markets led to its nationwide release and inclusion in value meal bundles.

Why it matters to C-stores: In the competitive foodservice landscape, standing out and increasing sales doesn’t always require a complete menu overhaul or the introduction of entirely new, complex items. McDonald’s strategy with “The Daily Double” offers a clear blueprint for C-stores: incremental improvements to existing, popular offerings can drive significant sales and customer satisfaction. This approach is often less risky and more cost-effective than launching entirely new product lines. It allows C-stores to leverage their current operational capabilities while still delivering a fresh, appealing experience that can boost both foodservice revenue and overall store traffic.

Deeper Analysis: The success of “The Daily Double” demonstrates that consumers place significant value on perceived freshness and enhanced quality, even when applied to familiar menu items. McDonald’s did not introduce a revolutionary new burger; instead, it elevated an existing, well-known product by adding simple, fresh components like lettuce and tomato, along with a different condiment. This shows that minor, thoughtful upgrades can generate substantial sales growth and positive customer response. For C-store operators, this is a crucial takeaway: there is no need to reinvent the wheel. Focusing on incremental improvements to popular, existing foodservice items, such as upgrading to a better-quality bun, offering fresher or more diverse toppings, or introducing premium sauces, can yield a high return on investment and effectively differentiate their offerings from competitors, without the complexity and cost associated with developing entirely new products.

Furthermore, the inclusion of “The Daily Double” on McDonald’s “McValue Meal Deal” bundle underscores the power of strategic bundling. This approach not only increases the perceived value for the customer but also drives higher sales volume by encouraging a complete meal purchase rather than just a single item. Convenience stores can readily apply this principle to their enhanced foodservice offerings. By creating attractive meal deals that pair an upgraded burger with a side and a drink, C-stores can increase the average transaction value and provide a compelling reason for customers to choose their store for a full meal solution. This strategy leverages the appeal of the enhanced item to boost sales across multiple categories, contributing to overall profitability.

What You Should Be Doing:

- Identify your top-selling foodservice items: Focus on popular existing burgers, hot dogs, or sandwiches that have a loyal customer base.

- Brainstorm simple enhancements: Consider adding fresh vegetables, premium cheeses, unique sauces, or different bread options to elevate these items. Think about what makes a burger feel “special.”

- Test new ingredients: Experiment with higher-quality buns, fresh-cut lettuce, ripe tomatoes, or gourmet condiments to see what resonates with your customers.

- Promote the “upgrade”: Clearly communicate the enhancements to your customers through signage, menu descriptions, and staff recommendations. Highlight the fresh ingredients or new flavors.

- Create value bundles: Pair your enhanced burger with a side (e.g., fries, chips) and a beverage to create an attractive meal deal, increasing the average ticket size.

- Gather customer feedback: Encourage customers to share their thoughts on the upgraded items to continuously refine your offerings.

More Information: CSP Daily News.

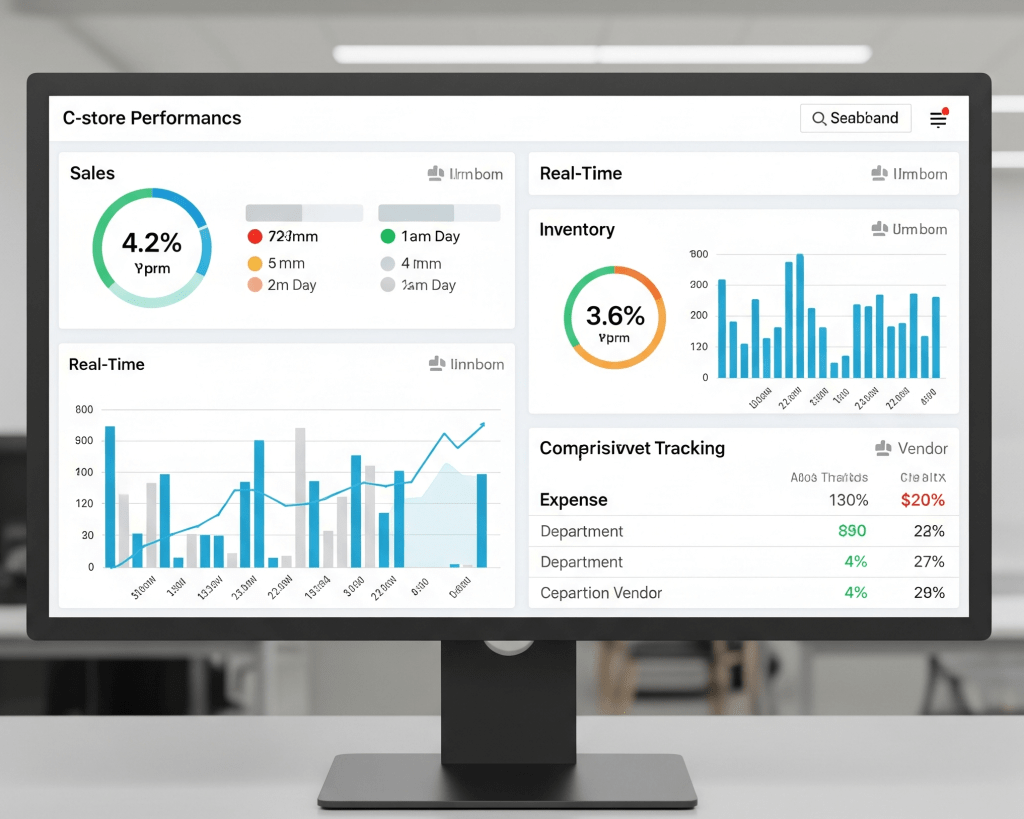

5. Taming the Beast: Getting a Handle on Operating Expenses

Operating expenses (OPEX) encompass all the ongoing costs a business incurs to maintain its daily operations, including rent, utilities, payroll, and marketing. Effectively managing OPEX is crucial for maintaining a healthy bottom line, improving operational efficiency, and staying competitive. Challenges include accurate budgeting and forecasting, balancing cost control with quality, and adapting to fluctuating costs influenced by external factors like inflation. Strategies for control involve unifying tech stacks, evaluating payment processing fees, prioritizing customer retention over acquisition, auditing expenses, optimizing space, implementing just-in-time inventory, leveraging online stores, streamlining fulfillment, utilizing business relationships, automating tasks, outsourcing, optimizing staff schedules, reducing opening hours, offering digital receipts, using energy-efficient appliances, and strategic discounting.

Why it matters to C-stores: In an industry where margins can be tight and competition is fierce, effectively managing your operating expenses can be the difference between thriving and merely surviving. OPEX directly impacts your profitability and cash flow. By gaining a firm handle on these costs, C-stores can remain agile, free up capital for growth opportunities, and invest in innovations that keep them ahead of the curve. It’s not just about cutting costs; it’s about optimizing every dollar spent to ensure maximum value and efficiency across your entire operation.

Deeper Analysis: Managing operating expenses is not solely about cutting costs; it is equally about making strategic investments that yield long-term efficiency and revenue growth. A prime example is the unification of a store’s technology stack. Integrating hardware and software into a single Point of Sale (POS) system can significantly reduce the total cost of ownership (TCO) by eliminating the need for multiple disparate systems and complex integrations. Businesses that have adopted this approach, such as The Conran Shop, reported a 50% reduction in TCO, alongside substantial increases in conversion rates and email marketing revenue. This demonstrates that technology, when strategically implemented, should be viewed as an investment that drives both cost reduction and revenue generation, rather than merely an expense.

Another critical aspect of OPEX management lies in the cost-effectiveness of customer retention versus acquisition. Acquiring new customers is notably more expensive, often more than five times the cost, than re-engaging existing ones. Focusing efforts on customer retention through loyalty programs, personalized outreach, and exceptional customer service can lead to increased profits and decreased operating costs, as repeat customers tend to spend more over time. This highlights that a well-executed customer retention strategy is a powerful, cost-efficient sales driver, directly impacting the marketing and acquisition components of OPEX.

A holistic approach to managing operating expenses involves meticulously auditing all expenditures to categorize them into “good costs” (unavoidable essentials), “bad costs” (those that erode profit, like unused space), and “best costs” (investments that deliver maximum profit, such as negotiated supplier prices or high-ROI marketing). This comprehensive audit helps identify areas where costs provide the least value, thereby freeing up capital that can be strategically reallocated for business growth and improved profitability. Furthermore, optimizing physical space, implementing just-in-time (JIT) inventory to reduce storage costs and improve cash flow, streamlining fulfillment and shipping processes, leveraging automation for repeatable tasks, and adopting energy-efficient appliances are all interconnected strategies that contribute to a leaner, more efficient operation. The shift towards hybrid shopping experiences, integrating e-commerce with brick-and-mortar, also introduces new OPEX considerations, such as digital platform fees and logistics, which necessitate a flexible budgeting strategy to adapt to evolving market dynamics.

What You Should Be Doing:

- Unify your technology stack: Invest in an integrated POS system that consolidates front-end and back-end operations, reducing the need for multiple systems and cutting overall tech costs.

- Evaluate payment processing fees: Regularly review what you’re paying for cashless transactions and explore more cost-efficient alternatives, such as encouraging debit card payments where feasible.

- Prioritize customer retention: Implement loyalty programs, personalize customer communications, and enhance customer service to encourage repeat business, as retaining existing customers is significantly cheaper than acquiring new ones.

- Conduct a thorough expense audit: Categorize all operational expenses to identify “bad costs” that can be reduced or eliminated, and “best costs” that should be optimized for maximum return.

- Optimize physical space and inventory: Consider if a smaller physical footprint with a “showrooming” model is viable and implement just-in-time inventory practices to reduce storage costs and improve cash flow.

- Leverage automation: Automate repeatable tasks like purchase orders, customer feedback emails, and inventory management to save time, reduce labor costs, and free up staff for higher-value activities.

- Streamline operations: Regularly review supplier contracts, negotiate better rates, and implement energy-efficient measures in your store (e.g., LED lighting, efficient HVAC) to reduce recurring utility costs.

- Be strategic with discounting: Use discounts sparingly and strategically to avoid training customers to only buy at reduced prices, which can erode profit margins.

More Information: CS News.

The Bottom Line

As we wrap up this week’s insights, it’s clear that the convenience store industry is dynamic, full of both challenges and exciting opportunities. From the evolving expectations of customers, driven by giants like Starbucks, to the unique digital behaviors of Gen Z, and the perennial quest for stronger foodservice margins and leaner operations – every piece of news offers a chance to refine your strategy.

The message is consistent: adaptability, a focus on customer experience, and smart operational management are your keys to success. Don’t just react to trends; proactively shape your business to meet and exceed what customers expect. By embracing authenticity, optimizing your existing strengths, and meticulously managing your costs, your C-store can not only survive but truly thrive in this competitive landscape. Keep learning, keep adapting, and keep serving your community with excellence.

Leave a comment