The convenience store industry is a dynamic landscape, constantly shifting with consumer trends, technological advancements, and economic pressures. For owner/operators, staying informed isn’t just a good idea—it’s essential for navigating the fast lane of business success. While the past week, from Monday, June 30th, through Friday, July 3rd, may have been shortened by the Independence Day holiday, it still delivered crucial signals about where the industry is heading.

This week’s news offers a powerful playbook, highlighting key areas where proactive attention can translate directly into improved operations, enhanced customer loyalty, and increased profitability. The continued expansion of mega-stores is significant. Evolving labor dynamics and the growing dominance of foodservice also matter. Additionally, there are subtle shifts in the fuel market. Understanding these developments is vital. The following analysis breaks down five significant news items, explaining their relevance to your business and outlining concrete steps you can take to capitalize on opportunities and mitigate challenges.

This Week’s Top 5 C-Store Insights & Your Action Plan:

1. The Mega-Store Momentum: Buc-ee’s Continues Its Expansion

The past week brought significant news from Buc-ee’s, with new locations opening their doors in Virginia on June 30th and Georgia on July 1st. These are not merely new stores; they are expansive travel centers, with the Virginia location alone spanning 74,000 to 75,000 square feet, equipped with over 120 fueling stations and 20 electric vehicle (EV) charging stations. This continued growth of large-format convenience and travel centers sends clear messages across the industry.

For convenience store owner/operators, this expansion highlights a critical shift in customer expectations. Buc-ee’s has gained renown for transforming the often-dreaded necessity of a pit stop into an unforgettable experience. Their approach, characterized by exceptionally clean restrooms, extensive house-made food offerings, and a vast array of beaver-branded merchandise, sets a new benchmark for customer engagement. This elevated standard means that customers are increasingly looking for value beyond just convenience; they seek a more engaging and enjoyable experience, even from a quick stop. This emphasis on the “experience economy” for convenience stores suggests that operators, regardless of size, must identify and amplify their unique appeal, whether through hyper-local product selections, exceptional staff interactions, or a particularly welcoming atmosphere.

Furthermore, Buc-ee’s success underscores the power of diversified and “sticky” non-fuel revenue streams. While fuel sales remain a significant component, the chain thrives on its in-store sales, which contribute disproportionately to overall profitability. The strategy of drawing customers inside with amenities like pristine restrooms encourages longer stays and higher spending on high-margin items. This demonstrates that every customer interaction, from the pump to the restroom, represents an opportunity to drive in-store purchases. Even other large chains like Casey’s are expanding their footprint with a strong focus on foodservice, such as their popular pizza offerings, to compete effectively. The strategic decision by Buc-ee’s to intentionally avoid certain customer segments, like semi-trucks, to preserve its core customer experience, further emphasizes the importance of understanding and catering to a defined target audience.

What You Should Be Doing:

- Elevate Your Store Image: Prioritize cleanliness, especially restrooms, as a foundational element of customer experience. A clean environment encourages customers to stay longer and spend more.

- Enhance In-Store Offerings: Focus on high-quality, fresh foodservice options and unique, local products that differentiate your store from larger chains. Consider items that offer a unique flavor profile or cater to specific local tastes.

- Optimize Customer Flow: Design your store layout to encourage customers to explore beyond the checkout counter and discover impulse buys. Strategic product placement in high-traffic areas can significantly increase visibility and sales.

- Leverage Local Appeal: Partner with local businesses for unique product assortments or co-promotions. Offering locally sourced items can provide a competitive edge that larger chains often cannot replicate.

- Invest in Staff Training: Ensure your employees provide exceptional, memorable customer service. Friendly, helpful staff can create a welcoming atmosphere that encourages repeat visits and positive word-of-mouth.

2. Labor Landscape Shifts: Union Contracts & Retention Strategies

The past week brought significant developments on the labor front, particularly within the grocery sector, which often sets precedents for the broader retail industry. On June 30th, nearly 3,000 grocery workers at UNFI Cub Foods and Haug’s Cub Foods ratified a new three-year union contract. They secured higher wages and increased pension contributions. There are also more guaranteed hours for part-time employees. Concurrently, UFCW 8-Golden State announced intensified negotiations for retail food contracts across California. They aim to standardize conditions for thousands of grocery workers.

These union successes signal a broader environment of increasing wage expectations across the retail sector, including convenience stores. The contractual wage increases, such as the 9.5% to 13% rise for full-time UNFI workers over the contract term, directly impact operational budgets and set new benchmarks for compensation. This comes at a time when the ability to hire and retain a necessary workforce remains the top business challenge for convenience stores, cited by 46% of operators, with finding qualified applicants and retaining employees identified as key barriers. Employees are increasingly advocating for living wages, affordable healthcare, reliable pensions, and improved working conditions, reflecting a fundamental shift in the employer-employee dynamic where expectations extend beyond mere compensation. The consequences of neglecting these evolving expectations are tangible; previous “skeleton crews” and reduced hours, as seen before the UNFI contract, directly compromise customer service quality.

This evolving labor landscape underscores the strategic importance of the employee experience. While union contracts directly influence tangible benefits, the underlying drive for these changes stems from a desire for overall employee well-being and a sense of value. The persistent challenges in hiring and retaining staff are not solely about pay; employees seek appreciation, a sense of belonging to a team, and alignment with their employer’s values. This suggests that a holistic employee experience strategy, one that mirrors the focus on customer experience, is now paramount. Operators must move beyond competitive wages to prioritize comprehensive training, clear career progression paths, and a positive work culture that values feedback and fosters long-term loyalty, thereby reducing costly turnover.

Furthermore, the discussion around labor naturally leads to the role of technology. While AI and automation are transforming retail operations, often touted for efficiency and cost reduction, their true potential in the labor context lies in empowering employees. The integration of technology must “work in partnership with employees”. When systems are intuitive and easy to operate, staff can engage more effectively with customers. Automating “time-consuming menial tasks” through AI, such as inventory management or administrative duties, frees employees to focus on “higher-value tasks like customer engagement”. This reframing of technology as an employee empowerment tool, rather than solely a cost-cutting measure, can improve job satisfaction and allow staff to dedicate more time to customer-facing activities that directly drive sales.

What You Should Be Doing:

- Review Compensation & Benefits: Regularly benchmark your wages and benefits against local and industry standards. Ensuring competitiveness is the first step in attracting and retaining talent.

- Invest in Training & Development: Implement comprehensive orientation, on-the-job, and career progression training programs. Employees who feel capable and see a path for growth are more likely to stay.

- Cultivate a Positive Work Environment: Actively seek employee feedback, recognize contributions, and foster a team-oriented culture. A supportive and appreciative environment significantly boosts morale and retention.

- Explore AI & Automation for Efficiency: Investigate AI-powered solutions for tasks like inventory management, administrative duties (e.g., drafting emails, job descriptions), and even customer service (e.g., chatbots). This can streamline operations, reduce manual workload, and free staff for more valuable interactions.

- Prioritize Employee Experience: Understand that retention is about more than just pay. It encompasses feeling valued, having growth opportunities, and working in a supportive environment that aligns with personal values.

3. Capitalizing on Holiday Traffic: Post-July 4th Learnings & Future Planning

The week concluded with the July 4th holiday, a period projected to see a significant surge in travel, with 72.2 million people expected to journey 50 miles or more. This substantial travel volume reliably translates into heavier traffic for convenience stores and gas stations, as holidays consistently bring increased visits. Retailers like 7-Eleven proactively capitalized on this by offering specific July 4th deals, including buy-one-get-one (BOGO) burritos and patriotic donuts. Similarly, local businesses were advised to boost holiday sales through targeted digital advertising, holiday-themed products, and engaging social media campaigns.

This annual holiday rush provides predictable traffic spikes that, when anticipated, allow for proactive planning. Consumers demonstrate a willingness to spend significantly on holiday-themed food and supplies, with July 4th spending estimated at nearly $300 per person. This spending extends beyond food and beverages to include patriotic-themed apparel and accessories. An optimized digital presence, including updated online listings with holiday hours and festive social media posts or contests, can significantly influence shopping decisions and attract customers. Moreover, offering in-store promotions and convenient, on-the-go lunch options during peak times, such as holidays and the consistent weekday lunch rush (11 a.m. to 1 p.m.), can maximize sales from this increased foot traffic.

A notable aspect of holiday traffic is the “local-first” mindset that often prevails. More than half of consumers tend to visit locations within six miles of their homes or workplaces. This, combined with advice for local businesses to leverage digital advertising and community connections for holiday sales, suggests that even during major holidays, a substantial portion of convenience store traffic originates from the immediate community. The recommendation to use “family and personal photos” in social media campaigns further reinforces the importance of cultivating this community connection. This implies that while catering to transient travelers is important, convenience stores should not neglect their local customer base during festive periods. Tailoring promotions, inventory, and marketing messages to resonate with the community can foster stronger, year-round loyalty.

Furthermore, holidays highlight the blurring lines between “convenience” and “experience” for shoppers. The increased traffic and significant spending on food and supplies are not just about quick fill-ups; they are about meeting broader celebratory needs. The emphasis on “decorating storefronts” and “festive social media posts” suggests that creating a holiday atmosphere and an enjoyable experience is as crucial as simply having products available. This means convenience stores should treat holidays as mini-events, creating a festive ambiance, offering unique holiday-themed products, and running engaging promotions that go beyond simple discounts to capture the celebratory spending mood.

What You Should Be Doing:

- Analyze Holiday Performance: Review your July 4th sales data to identify top-performing products, successful promotions, and peak traffic times. This data is invaluable for future planning.

- Optimize Digital Presence: Ensure your holiday hours are updated on Google My Business and other online listings. Use social media to promote holiday-themed products, deals, and contests to attract customers.

- Plan Proactively: Utilize insights from past holidays to strategically plan inventory, staffing levels, and promotions for upcoming long weekends and festive periods throughout the year.

- Curate Holiday Inventory: Stock patriotic-themed items, BBQ essentials, and popular snacks and beverages. Consider offering limited-time, festive foodservice options that align with the holiday spirit.

- Engage with Creativity: Run social media contests, such as asking for reviews in exchange for entries, and use clever captions and community-focused photos to build anticipation and drive visits.

4. Navigating Fuel Market Dynamics: Prices & Regulatory Impacts

The week saw a slight increase in the U.S. average retail price of regular-grade gasoline, rising 10.5 cents per gallon to $3.31, according to the Lundberg Survey on June 30th. Despite this short-term fluctuation, the broader outlook for summer 2025 suggests overall stability, with the EIA projecting national average prices around $3.14 per gallon and no major supply-side fears dominating market sentiment. However, a significant regulatory change took effect on July 1st, 2025, with California’s updated Low Carbon Fuel Standard (LCFS) regulation, which could add 5 to 8 cents per gallon to fuel costs in the state.

For convenience store operators, fuel price sensitivity remains a constant consideration. Even minor price fluctuations can influence consumer perception and purchasing decisions, as fuel prices correlate strongly with both fuel and in-store trips. Regulatory changes, such as California’s LCFS, directly impact operational costs and can accelerate the shift towards cleaner fuel options like electric vehicles. This also highlights the growing importance of understanding regional variations in the fuel market. The long-term trend of reduced dependence on petroleum and the consistent focus on in-store sales further reinforce the strategic necessity for convenience stores to diversify revenue streams beyond fuel.

This dynamic suggests that fuel can be strategically viewed as a “loss leader” to drive in-store profitability. While fuel sales account for a large portion of revenue, in-store sales generate a disproportionately higher percentage of profit—up to 70% of profit from 30% of revenue. The strong correlation between gas prices and in-store trips implies that competitive fuel pricing can serve as a powerful draw to get customers onto the lot, where the real profit opportunity lies within the store. This requires optimizing the in-store experience with enticing signage and a thoughtful store layout to convert fuel customers into high-margin in-store purchasers.

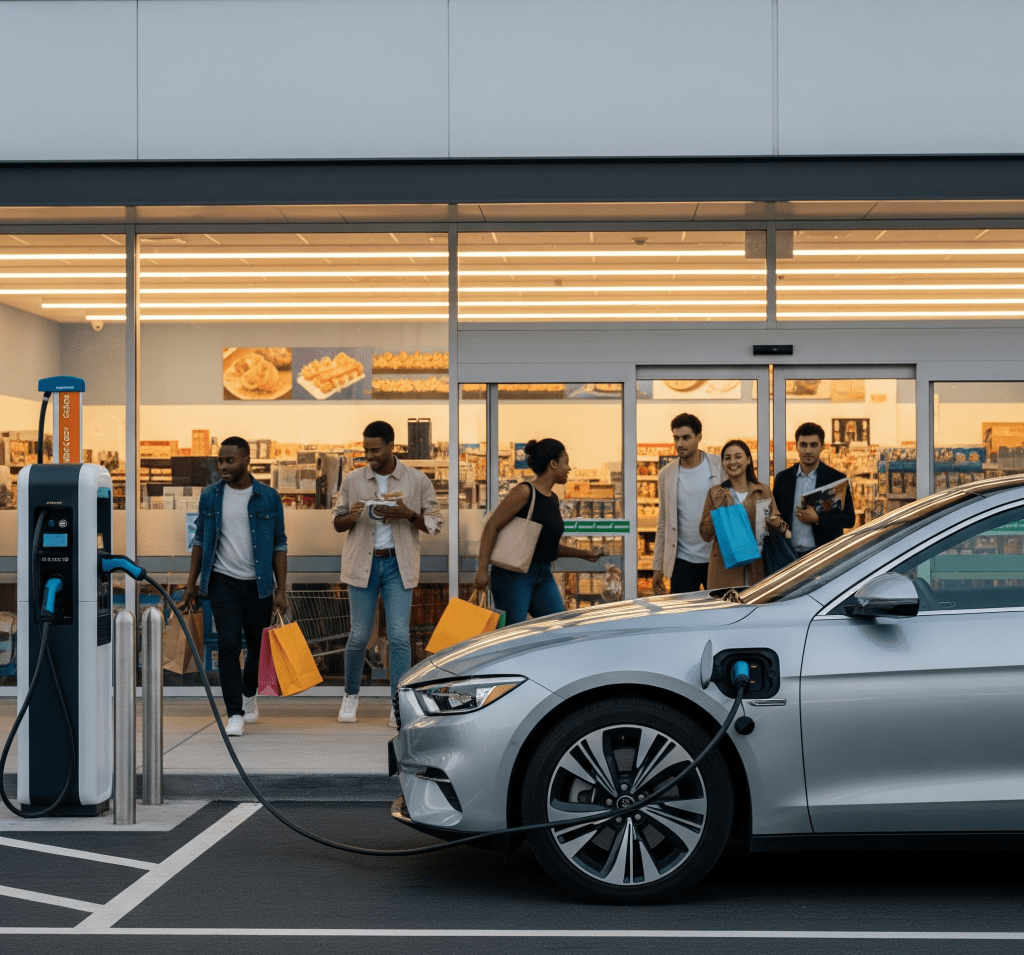

Furthermore, the increasing adoption of electric vehicles presents a growing opportunity for “charging stations as a destination.” EV charging stations are becoming profitable for travel centers. Unlike the average two to three minutes it takes to fill a gas tank, EV charging requires a longer stay, creating a captive audience. Convenience stores can capitalize on this by making EV drivers feel welcome and offering incentives for in-store purchases during their charging time. For operators considering EV charging infrastructure, the focus should extend beyond the charging revenue itself to how to maximize the additional in-store sales from these customers during their extended visit. This necessitates tailored offerings and promotions designed to appeal to this specific demographic.

What You Should Be Doing:

- Monitor Fuel Margins Closely: Stay agile with your fuel pricing strategy, understanding that wholesale price cuts can quickly change margins and impact profitability.

- Diversify Revenue Streams: Continue to prioritize and expand high-margin in-store categories, especially foodservice and unique merchandise, to reduce reliance on fuel profits and enhance overall business resilience.

- Evaluate EV Charging: Research the feasibility of installing EV charging stations. Consider the long-term shift away from petroleum and the potential to attract new, captive customer segments who will spend time in your store.

- Incentivize In-Store EV Purchases: If you have or plan EV chargers, offer promotions or loyalty rewards specifically for EV drivers to encourage them to spend inside your store while their vehicles charge.

- Stay Informed on Regulations: Keep abreast of state and local fuel regulations, such as Low Carbon Fuel Standards, that can impact your operational costs and pricing strategies in the long term.

5. Foodservice Dominance: C-Stores as Culinary Destinations

The past week’s news strongly reinforced the ongoing transformation of convenience stores into genuine food destinations. The U.S. convenience store foodservice market is projected to reach an impressive $72.5 billion in 2025 , building on an impressive 16.3% increase in prepared meals during 2024. This growth in foodservice within convenience stores has notably outpaced that of quick-service restaurants (QSRs), with a remarkable 72% of consumers now viewing convenience stores as a viable alternative to QSRs. The industry’s focus is clearly on enhancing quality, fostering innovation, and delivering value in its food offerings.

This trend represents a major growth opportunity, as foodservice already accounts for 23% of in-store sales and is poised for continued significant expansion. Convenience stores are increasingly competing directly with QSRs, with consumers demonstrating openness to made-to-order meals from these locations and perceiving the food as fresh and high-quality. Evolving consumer preferences are driving this shift, with shoppers seeking quick, fresh, and high-quality meal options. There’s also a growing interest in healthier choices, with 55% of Americans indicating a desire to eat healthier, alongside a demand for “maximalist” or elevated flavor profiles. Value, defined as “more bang for the buck,” remains a key driver for consumer spending. Integrating technology, such as mobile ordering, self-service kiosks, and AI-powered inventory management, is becoming crucial for enhancing the foodservice experience and optimizing operational efficiency.

This significant shift highlights foodservice as the new primary driver of foot traffic. Historically, fuel drew customers to the lot, who might then decide to enter the store. Now, high-quality foodservice is transforming convenience stores into “destination points rather than just quick stops”. Lunchtime is already a peak period for convenience stores, posing a direct “threat to QSRs”. This indicates that appealing, high-quality foodservice can independently draw customers, even without a fuel purchase. Convenience store operators should actively market their foodservice offerings as a primary reason to visit, investing in branding, menu innovation, and convenience features that rival traditional QSRs.

Furthermore, the concept of “value” in foodservice extends beyond just price. While inflation has eased, consumers remain mindful of their spending, shifting towards “intentional spending”. However, promotions have become a significantly stronger motivator. This suggests that consumers are not just seeking the cheapest option but rather “more bang for the buck” and a “total value equation” that balances quality, convenience, and perceived benefits. This means convenience stores should focus on communicating the holistic value of their foodservice offerings, emphasizing freshness, customization, speed, and quality, rather than solely competing on price with QSRs. Bundled deals and seamless integration with loyalty programs can further enhance this perceived value.

Key performance indicators and growth areas for the convenience store industry in 2025 underscore the importance of foodservice:

- C-store Retail Sales Growth (2023-2024): The industry saw 1.5% year-over-year growth.

- C-store Foodservice Sales Growth (2024): Foodservice experienced a 5% growth.

- Prepared Meals Growth (2024): There was an impressive 16.3% increase in prepared meals.

- C-store Foodservice Sales Projected (2025): The market is projected to reach $72.5 billion.

- Consumer Perception of C-stores as QSR Alternative: A significant 72% of consumers now view c-stores as a viable alternative to quick-service restaurants.

- Consumer Perception of Food Freshness: 43% of consumers believe c-store food is as fresh as what they’d get at a QSR or grocery store.

- Consumer Interest in Loyalty Programs: A strong 79% of Gen Z consumers express interest in loyalty programs.

- Top Business Challenge: The ability to hire and retain a necessary workforce remains the top business challenge for 46% of operators.

What You Should Be Doing:

- Expand & Innovate Your Menu: Offer a wider variety of prepared meals, focusing on fresh, healthier options and exciting flavor profiles (e.g., hot honey, sweet & spicy, “maximalist” flavors). Experiment with unique offerings that cater to evolving tastes.

- Emphasize Value: Create compelling meal deals, combo offers, and loyalty program incentives that provide a strong “bang for your buck.” Highlight the quality and convenience to appeal to intentional spending habits.

- Leverage Technology: Implement mobile ordering, self-service kiosks, and AI-powered inventory management systems. These tools improve efficiency, reduce waste, and significantly enhance the customer experience.

- Focus on Quality & Freshness: Ensure your prepared foods are consistently high quality. As consumers increasingly view convenience store food as comparable to QSRs, maintaining high standards is crucial for reputation and repeat business.

- Consider Private Label: Explore developing unique private label food and beverage options. This can differentiate your store, offer exclusive value, and build brand loyalty.

The Bottom Line: Your Playbook for a Profitable Future

The past week, though brief due to the holiday, provided clear and actionable signals for convenience store owner/operators. The industry is undergoing a rapid evolution, driven by shifting consumer expectations and accelerating technological advancements. From the monumental growth of mega-stores like Buc-ee’s, which are redefining the customer experience, to the critical shifts in the labor market demanding greater attention to employee well-being, and the undeniable rise of foodservice as a primary traffic driver, every piece of news points towards a future where adaptability and strategic investment are paramount.

The fuel market, while stable, continues to underscore the importance of in-store diversification, particularly with the emerging opportunity presented by EV charging. Ultimately, the success of your convenience store hinges on your ability to understand these interconnected trends and respond proactively. Prioritize customer experience and value your employees. Strategically diversify your revenue streams and embrace technology to enhance your burgeoning foodservice offerings. By doing so, you are not just reacting to change—you are actively shaping a more profitable and resilient future for your business. Seize these opportunities, and your convenience store can continue to thrive as a vital hub in your community.

Leave a comment