Hey there, convenience store owner/operators! It’s Tuesday, July 15th, and as I sift through the latest industry news from Monday, a few headlines really jumped out at me. These aren’t just isolated stories; they’re vital signs for where our industry is headed and understanding them is key to staying ahead. As someone who lives and breathes c-store operations, I want to share my take on 5 crucial news items that I believe will significantly impact your business in the coming year. Let’s dive in!

1. The Great Indoors: How C-Stores Can Adapt to At-Home Consumers

A recent report from Circana highlighted that U.S. consumers are increasingly choosing to stay home to save money. We’re seeing a rise in demand for small appliances for meal prep, coffee making, and even in-home entertainment. This “return to home” trend mirrors some behaviors we saw during the pandemic, driven by a desire to cut costs on everyday expenses. It’s simply less expensive to eat and entertain at home.

Why It Matters to C-Store Owner/Operators: This trend directly impacts foot traffic and impulse buys. If consumers are spending more time and money at home, they’re naturally making fewer trips out, which means fewer opportunities for them to walk through your doors. This shift in consumer behavior demands a re-evaluation of how we capture their attention and dollars.

What You Should Be Doing:

- Boost Your In-Store Foodservice: If people are eating at home more, focus on easy, high-quality meal solutions they can grab and go. Think about expanding your prepared food offerings, ready-to-heat meals, or meal kits that offer convenience for busy families.

- Leverage Digital and Delivery: Since at-home consumption is up, make it easier for customers to get your products without coming into the store. Strengthen your delivery partnerships and consider developing a user-friendly app for online ordering and loyalty programs.

- Optimize Product Assortment for At-Home Needs: Think beyond traditional snacks. Could you offer more bulk items, larger beverage packs, or ingredients for simple home meals? Consider items like coffee beans, basic cooking essentials, or even small, convenient kitchen gadgets that align with this trend.

More Information: NACS.

2. The Price is Right… For Suppliers: Navigating Inflation’s Impact

Conagra Brands’ CFO recently stated that tariffs and rising meat prices are expected to significantly drive inflation into fiscal year 2026. Tariffs on imported goods like steel, aluminum, and certain Chinese products are adding substantial costs, while animal protein prices (beef, chicken, pork, eggs, turkey) are projected to rise by double digits. Other industry experts are confirming the widespread impact of tariffs across the food supply chain, affecting everything from coffee and paper products to equipment.

Why It Matters to C-Store Owner/Operators: Inflation directly impacts your cost of goods sold (COGS) and, ultimately, your margins. Higher supplier prices mean you either absorb the cost (eating into your profits) or pass it on to consumers (risking price sensitivity and reduced sales). This isn’t just about food; it’s about all imported supplies affecting your operations.

What You Should Be Doing:

- Review Your Pricing Strategy Continuously: Don’t be afraid to adjust prices where necessary but communicate value to your customers. Consider bundling or loyalty programs to offset perceived price increases.

- Diversify Your Supply Chain: Explore domestic suppliers for goods heavily affected by tariffs. Having alternative sources can help mitigate price shocks and ensure product availability.

- Focus on Cost Efficiencies: Look for ways to reduce operational costs. This could involve optimizing inventory management with AI-driven systems, improving energy efficiency, or negotiating better terms with non-impacted suppliers.

More Information: Food Dive.

3. The Foot Traffic Challenge: Turning Visitors into Regulars

7-Eleven’s parent company, Seven & i, reported a 6% year-over-year drop in North American foot traffic for the fiscal first quarter, marking five consecutive quarters of decline. This is a significant concern for the industry giant, prompting them to focus on strategies like adding more quick-service restaurants (QSRs) within their stores and boosting delivery sales. Meanwhile, other reports indicate that 7-Eleven is closing 444 “underperforming” locations in North America due to rising costs, declining sales, and reduced foot traffic, emphasizing a broader industry trend of re-evaluating physical footprints.

Why It Matters to C-Store Owner/Operators: While 7-Eleven is a large chain, their struggles with foot traffic are a canary in the coal mine for the entire industry. Shifts in consumer behavior, coupled with increased competition from e-commerce and other retail formats, mean that simply opening your doors isn’t enough to guarantee steady customer flow. Your survival depends on actively driving traffic.

What You Should Be Doing:

- Enhance Your Foodservice Offering: Just like 7-Eleven, consider adding more compelling QSR options or expanding your made-to-order food. High-quality foodservice is a proven traffic driver that can transform your store into a destination.

- Invest in Loyalty Programs and Personalization: Reward frequent customers and use data to understand their preferences. Personalized offers can incentivize visits and increase basket size.

- Improve the In-Store Experience: Focus on cleanliness, appealing store layouts, and efficient service. A positive, convenient, and enjoyable in-store experience encourages repeat visits even if overall foot traffic is down.

More Information: CStore Dive.

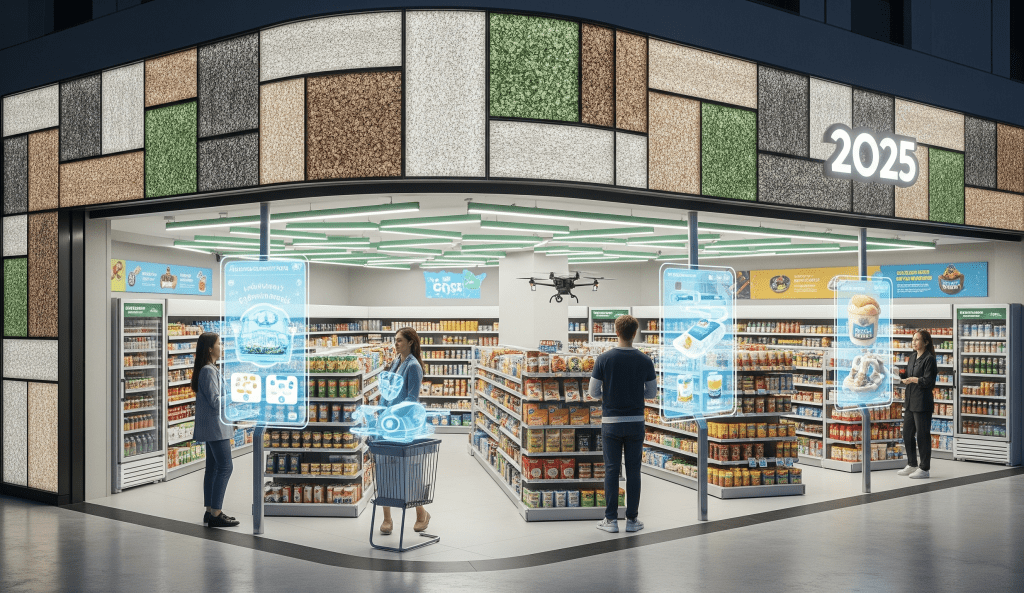

4. 2025 Crystal Ball: Peering into the C-Store Industry’s Future

The c-store industry is buzzing with questions for the remainder of 2025, from potential major acquisitions (like Alimentation Couche-Tard and Seven & i, or the Sunoco/Parkland Corp. deal) to ongoing concerns about inflation and the continued evolution of foodservice. The key themes emerging are significant M&A activity and a relentless focus on foodservice innovation, with many retailers hiring experienced leaders for their food and beverage programs. Made-to-order food is going mainstream, with 85% of U.S. shoppers trying it at c-stores, and 72% now view c-stores as viable QSR alternatives. EV charging is also drawing new customers, especially younger demographics.

Why It Matters to C-Store Owner/Operators: This signals that the industry is not stagnant. Larger players are looking for scale and new efficiencies through mergers, which can alter the competitive landscape. More importantly, it reinforces that foodservice is no longer a sideline; it’s a central pillar for growth. New customer segments, like EV drivers, also present opportunities.

What You Should Be Doing:

- Prioritize Foodservice as a Core Business: If you haven’t already, treat your foodservice operation like a restaurant. Invest in quality ingredients, skilled staff, and a diverse menu that can compete with traditional QSRs.

- Stay Informed on Industry Consolidations: While you might not be directly involved, large mergers can affect your supplier relationships, pricing, and competitive environment. Being aware helps you anticipate changes.

- Explore New Revenue Streams: Consider adding amenities like EV charging stations, which can draw new customer demographics and increase dwell time, creating opportunities for larger basket sizes.

More Information: CStore Dive.

5. From Warehouse to Counter: Protecting Your Supply Chain Amidst Mergers

Reports indicate that US Foods is considering a takeover of Performance Food Group (PFG), a move that would create the largest food distributor in the U.S., surpassing current leader Sysco. This potential merger, combining the second and third largest distributors, would likely face significant regulatory scrutiny. Both companies have been actively acquiring smaller distributors, signaling a broader consolidation trend in the foodservice distribution sector.

Why It Matters to C-Store Owner/Operators: Your distributors are the lifeblood of your operation. A major merger like this could lead to changes in pricing, delivery schedules, product availability, and even the level of service you receive. While it might offer some benefits through scale, it also creates uncertainty and potentially fewer competitive options for you.

What You Should Be Doing:

- Maintain Strong Relationships with Your Current Distributors: Even if changes are on the horizon, good relationships can help ensure smoother transitions and better support.

- Diversify Your Distributor Relationships (Where Possible): If you rely heavily on one distributor, consider building relationships with secondary or specialty distributors. This can provide a safety net and more options if your primary supply chain is disrupted.

- Review Contracts and Terms Proactively: Understand the implications of any potential changes in the distribution landscape on your current agreements. Be ready to renegotiate or explore new partnerships if necessary.

More Information: Restaurant Business Online.

The Bottom Line

The convenience store industry is dynamic, constantly evolving, and sometimes, it feels like we’re navigating a white-water river. But what these 5 news items from July 14th tell me is that the current is strong, and those who adapt will thrive. Consumers are changing their habits, inflation is a real challenge, foot traffic needs to be earned, and the very structure of our supply chain is shifting.

My advice? Don’t just react. Proactively lean into foodservice, embrace digital solutions, relentlessly focus on efficiency, and keep a close eye on the bigger industry picture. Your ability to anticipate and respond to these trends will not only ensure your survival but also position you for significant growth in 2025 and beyond. Let’s keep those doors open and those profits flowing!

Leave a comment