Greetings, fellow convenience store leaders! I’m here to share some critical insights from the news that dropped on Thursday, July 17th, that I believe every owner-operator should be paying close attention to. In our fast-paced industry, staying ahead of the curve isn’t just an advantage—it’s essential for survival and growth. Today, we’re diving into five key developments that could impact your operations, strategies, and bottom line. So, let’s get started and explore what these headlines mean for your business and what you should be doing right now to leverage these trends!

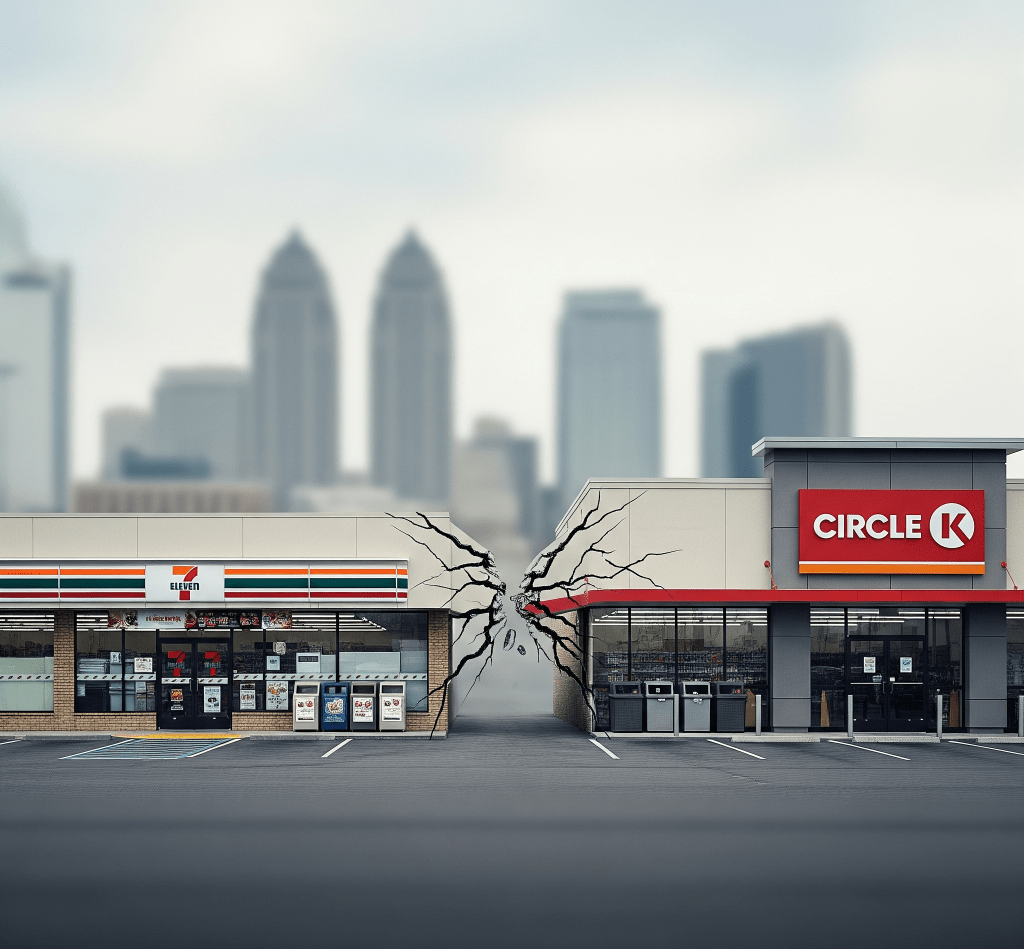

1. The Shifting Landscape of Big Retail Mergers

First up, the news that Alimentation Couche-Tard, the powerhouse behind Circle K, has called off its takeover bid for Seven & i, the parent company of 7-Eleven. This wasn’t just another corporate maneuver; it signals a significant shift in the M&A landscape within our industry. Couche-Tard cited a “lack of constructive engagement” from Seven & i, pointing to the complexities and challenges even the largest players face in consolidating market share. Seven & i will now focus on its standalone value creation plan, including potentially taking its North American operations public.

Why You Should Be Interested: While you might not be making multi-billion dollar bids, this unraveling mega-deal highlights the intricate dance of competition and consolidation. For independent and smaller chain operators, it means the competitive landscape remains dynamic. Large players like Couche-Tard will continue seeking growth, potentially through smaller acquisitions, and focusing on integrating their existing portfolios like GetGo. This could lead to shifts in market presence and competitive strategies in your local areas.

What You Should Be Doing:

- Stay Agile: Be prepared to adapt quickly to changes in your local competitive environment, whether it’s a new large chain store opening or an existing one revamping its offerings.

- Focus on Your Niche: Identify what makes your store unique and double down on it. It could be exceptional customer service, a specific product assortment, or a strong community connection.

- Optimize Operations: Large companies seek efficiency. Continuously look for ways to streamline your own operations, reduce waste, and improve profitability, regardless of external market shifts.

- Keep an Eye on Local Acquisitions: Be aware of any smaller, local competitors that might be acquisition targets for larger entities, as this could change the competitive dynamics.

Find the news article here: Alimentation Couche-Tard Ends Takeover Bid for Seven & i

2. The Lidl Effect: Lessons in Efficiency and Value

We’ve seen the rise of discount grocers like Aldi and Lidl dramatically impact the wider grocery sector. While a direct competitor to many supermarkets, the insights from Lidl’s aggressive pricing and efficiency models are incredibly relevant to convenience stores. Lidl has consistently offered the cheapest overall baskets, often setting prices 25% below competitors, and their market entry has forced other retailers to significantly cut prices, sometimes by over 50% for staple products. They prioritize private labels and meticulous supply chain management to keep costs low while delivering quality.

Why You Should Be Interested: The “Lidl Effect” isn’t confined to traditional grocery. Consumers are increasingly value-conscious, and the efficiency-driven model of these discounters has reset customer expectations for price and quality. While you can’t always match their scale, understanding their strategies for low overhead, strong private label offerings, and fresh product focus can provide valuable lessons for your own operations.

What You Should Be Doing:

- Re-evaluate Your Pricing Strategy: Are you competitive on everyday essentials? Consider a “value” segment for key items that resonate with price-sensitive customers.

- Explore Private Label Opportunities: If feasible, consider introducing your own branded products for popular convenience items. This builds loyalty and often improves margins.

- Focus on Freshness and Quality: Lidl’s success is not just about price; it’s also about perceived quality, especially in fresh categories. Ensure your fresh food offerings are top-notch and visually appealing.

- Optimize Your Supply Chain: Even at your scale, look for ways to improve inventory management and reduce waste to enhance efficiency.

Find more on Lidl’s impact: Lidl Significantly Pressures US Supermarket Chains to Cut Prices

3. Ozempic: Is it Shrinking Your Snack Sales?

Here’s a news item that might sound far-fetched but has serious implications: GLP-1 medications like Ozempic and Mounjaro are estimated to have already reduced U.S. grocery spending by $6.5 billion. These medications suppress appetite, leading consumers to buy less food overall, opting for smaller package sizes and healthier choices.

Why You Should Be Interested: This isn’t just about grocery stores; it’s about shifting consumer behavior that directly impacts impulse purchases and snack sales—the bread and butter of many convenience stores. If your customers are feeling less hungry or are more conscious about what they eat, your sales of candy, sugary drinks, large bags of chips, and processed foods could be affected.

What You Should Be Doing:

- Diversify Your Assortment: Increase your stock of “better-for-you” options, including healthier snacks, protein-rich items, and fresh fruit.

- Offer Smaller Portion Sizes: Cater to reduced appetites by stocking more single-serve or smaller-sized packages of popular items.

- Highlight Healthy Choices: Make it easy for customers to find healthier options through clear labeling and prominent placement.

- Monitor Sales Data Closely: Track sales trends for high-sugar and high-fat items versus healthier alternatives to understand how this trend is impacting your specific store.

Read more about Ozempic’s impact: Ozempic Costing Grocery Stores Billions

4. Gen Z’s Loyalty: The Private Label Powerhouse

A new report projects that by mid-2026, Gen Z will become the most loyal purchasers of private label brands, spending 18.4% of their CPG and general merchandise budget on them. This generation views store brands as innovative, trendy, and premium, driven by a desire for affordable luxuries and inflation.

Why You Should Be Interested: Gen Z is your future customer. Their growing preference for private labels isn’t just a cost-saving measure; it’s a shift in perception. If they see store brands as cool and high-quality, this opens a massive opportunity for convenience stores to attract and retain this crucial demographic. Developing or expanding your own private label offerings can build brand loyalty and increase margins.

What You Should Be Doing:

- Consider Private Label Development: Evaluate popular categories in your store where a private label alternative could be successful, focusing on quality and modern branding.

- Market Your Store Brands: Don’t just stock them; actively promote your private label products as high-quality, value-driven alternatives.

- Understand Gen Z Preferences: Research what drives Gen Z’s purchasing decisions beyond just price, such as sustainability, unique flavors, and convenience.

- Focus on Value and Quality: Ensure any private label products you introduce meet or exceed the quality expectations of national brands to build trust and repeat business.

Explore Gen Z’s private label loyalty: Gen Z Forecast to Become Most Loyal Purchasers of Private Label

5. The Pickle Phenomenon: More Than Just a Condiment

Believe it or not, pickles are having a major moment! From fast-food chains like Popeyes and Sonic rolling out pickle-themed menus (think pickle-glazed wings and pickle-seasoned tots) to the viral “pickle lemonade” and even dill pickle-flavored snacks from major brands, the “swalty” (sweet and salty) profile of pickles is resonating strongly, especially with younger demographics like Gen Z.

Why You Should Be Interested: This isn’t just a quirky food trend; it’s a clear signal of adventurous palates and the power of unique, trending flavors. Convenience stores are perfectly positioned to capitalize on impulse buys and novelty items. Tapping into popular food trends like the “pickle-palooza” can drive foot traffic, generate buzz, and increase sales.

What You Should Be Doing:

- Embrace Trendy Flavors: Look for opportunities to introduce snacks, beverages, or even grab-and-go food items that feature popular and adventurous flavor profiles.

- Stock Pickle-Themed Products: From classic dill pickles to innovative pickle-flavored chips, popcorn, or even pickle-infused beverages, ensure you have a variety to meet demand.

- Create Engaging Promotions: Partner with suppliers or create your own in-store promotions around trending items. Think “Summer of Pickles” specials!

- Monitor Social Media Trends: Stay tuned into platforms where food trends often start (like TikTok) to identify the next big thing that could be a hit in your store.

Dive into the pickle craze: Bites and Sips: Summer of Pickles and Promos and Don’t Hold the Pickles: Sonic’s CMO on Going All-In on Dining Trend

The Bottom Line

There you have it, 5 news items from Thursday, July 17th, that offer a clear roadmap for convenience store owner-operators. From the shifting strategies of retail giants to the evolving tastes of Gen Z and the surprising impact of health trends, the key takeaway is clear: our industry demands constant vigilance and a proactive approach. By staying informed, adapting your strategies, and focusing on what truly matters to your customers, you’re not just surviving, you’re setting your store up for long-term success. Keep pushing forward, keep innovating, and let’s make the most of these insights!

Leave a comment