Hey there, convenience store trailblazers! As another week wraps up, I’ve been sifting through the latest industry buzz, and let me tell you, Thursday, July 24th, served up some truly interesting insights. It’s easy to get caught up in the daily grind, but taking a moment to zoom out and see the bigger picture is what separates thriving operations from those just getting by.

Our industry is a whirlwind of change, isn’t it? From shifting consumer habits to economic pressures and evolving regulations, staying on top of the news isn’t just smart, it’s essential for your bottom line. That’s why I’m here to break down the 5 (plus one bonus!) most compelling news items I spotted yesterday, all designed to help you make smarter decisions for your store.

In this post, we’ll dive into what these headlines mean for your business, why you should care, and most importantly, what practical steps you can take right now to turn these insights into opportunities. Let’s get to it!

1. The GLP-1 Shift: Reshaping Your Foodservice Strategy

The buzz around GLP-1 weight-loss medications like Ozempic and Wegovy is growing louder. It’s not just a medical trend. It’s a profound shift in how consumers eat. These drugs work by suppressing appetite and promoting portion control, leading users to consume less overall. Within six months of taking the medication, studies show that households with GLP-1 users are cutting grocery spending by approximately 6%. This impact is particularly pronounced on calorie-dense, processed items like chips, baked goods, cookies, and savory snacks, with an 11% decline in savory snacks alone.

Conversely, there’s a noticeable increase in demand for fresh produce, yogurt, and especially protein-rich foods. In fact, a recent Mintel study revealed 53% of people are actively trying to increase protein in their diet. CPG companies like Conagra are already responding by designing new, small-portion, high-protein frozen meals with “GLP-1-friendly” badges. This isn’t a fleeting fad; experts project the GLP-1 drug market to reach $139 billion by 2030, a 38% increase from previous projections. For convenience stores, GLP-1 users’ trips are decreasing. They are less frequent for indulgent foods like ready-to-drink coffee, frozen desserts, chips, alcohol, and candy. However, these consumers are “not spending less, but they are demanding more from what they consume. The hunger might be lower but their expectation for purpose is higher”.

Why it matters to C-store Owner/Operators: This trend directly impacts your sales mix, especially in high-margin categories like snacks, candy, and sugary beverages. Your traditional impulse-driven sales model is facing a significant challenge. The rise of GLP-1 users presents a massive opportunity to redefine your store as a destination for intentional, health-conscious purchases. If around 1 in 6 American households already has a GLP-1 user, and that number is growing rapidly, you simply cannot afford to ignore this demographic.

This consumer trend is more than just a niche health interest; it represents a fundamental change in how people approach their daily dietary choices. This means your core product categories, traditionally filled with quick, indulgent grabs, are directly affected. It’s not about losing customers, but about recognizing their evolving needs and priorities. Your foodservice program, in particular, stands to gain or lose significantly. This is where you can truly differentiate yourself from competitors and cater to the evolving needs of these high-value customers. The need to adapt extends to how you present your offerings. Simply stocking new, healthier products isn’t enough; the way you merchandise them and the narrative your store communicates about its food options will be crucial. This shift requires a thoughtful approach to store design, category management, and marketing to signal your commitment to healthier choices.

What You Should Be Doing:

- Reimagine Your Assortment: Shift your focus from “indulgence first to intention first”. Expand your grab-and-go sections with high-protein, low-sugar, and portion-aware items. Examples include hard-boiled eggs, Greek yogurt, string cheese, tuna packs, jerky, clean-label protein bars, veggie sticks with hummus, and smaller wraps.

- Innovate Your Foodservice: Update your hot and fresh menus to include more grilled proteins, build-your-own salads, and customizable bowls. Focus on flexibility, customization, and portion control.

- Elevate Your Beverage Offerings: Beyond just flavor and caffeine, stock drinks that support hydration, energy, or appetite control, such as electrolyte boosters, protein shakes, and fiber-enhanced beverages.

- Strategic Merchandising & Signage: Create dedicated “light-and-energizing” or “functional fuel” sections. Use clear language that focuses on “fuel, balance, and control” to signal that you understand the GLP-1 consumer’s mission.

- Monitor Sales Data: Pay close attention to sales trends in your indulgent categories versus healthier options. This data will inform your inventory adjustments and marketing efforts.

More Information: You can read more about the impact of GLP-1 drugs on consumer preferences here: Food Dive.

2. Candy’s Cost Crunch: Navigating Rising Prices

Get ready for a bittersweet reality: the price of your favorite chocolate bars and candies is going up, and it’s not just a little bump. Major players like Nestlé and Hershey are flagging double-digit price hikes for 2025. The primary culprit? Soaring cocoa prices, which have hit historic peaks, nearly doubling in early 2025 compared to the previous year. This isn’t just market volatility; it’s a global cocoa shortage driven by a combination of factors: disease outbreaks, climate change (droughts, extreme heat) ravaging crops in West Africa (which produces 80% of the world’s cocoa), and chronic underinvestment in cocoa farms.

While some manufacturers saw increased revenues in 2024 due to strong prices, the volume of confectionery sales is already showing signs of decline, indicating consumer resistance. Experts warn that further price hikes could exacerbate this drop in demand. The underlying issues suggest structurally higher cocoa prices for the foreseeable future, meaning this isn’t a temporary blip.

Why it matters to C-store Owner/Operators: Candy is a cornerstone of convenience store sales, historically boasting high gross margins (over 51% in 2022) and acting as a powerful impulse “basket builder”. These price increases directly threaten those healthy margins and sales volumes. You’re caught between rising wholesale costs and consumer price sensitivity. As inflation continues to squeeze household budgets, customers are becoming more selective, favoring quality over quantity, and potentially cutting back on discretionary indulgences like candy.

The rising cost of cocoa is not a transient supply chain issue; it’s a long-term structural problem exacerbated by climate change and chronic underinvestment in cocoa farming. This means that high chocolate prices are likely the new normal, not a temporary market fluctuation, requiring a fundamental shift in your candy strategy. While candy has historically been a high-margin, impulse category, the combination of sustained rising prices and changing consumer preferences (influenced by factors like GLP-1 usage and strained budgets leading to a focus on quality over quantity) creates a potential “perfect storm” for reduced volume sales and squeezed profitability in this category. Simply passing on price increases might lead to significant volume erosion, making the high gross margin less meaningful if fewer units are sold. This situation compels you to consider the price sensitivity of demand for your candy offerings and potentially explore alternative “affordable indulgence” categories to maintain overall basket size and profitability.

What You Should Be Doing:

- Strategic Pricing & Margin Management: Review your candy category pricing carefully. While you’ll need to pass on some increases, consider the elasticity of demand for different products. Could a slight margin reduction on a high-volume item maintain sales, or is a full price pass-through viable for premium options?

- Optimize Inventory & Displays: With potential volume declines, avoid overstocking. Focus on popular, high-turnover items. Consider optimizing display space for other impulse categories that might see growth (e.g., protein snacks, healthier options).

- Explore Alternative Indulgences: Diversify your “treat” offerings. Look into non-chocolate candies, healthier sweet snacks, or even small, premium baked goods that offer an “affordable indulgence” experience without the cocoa price pressure.

- Communicate Value: If you do raise prices, ensure your staff is prepared to explain (briefly and positively) the reasons, focusing on quality or unique aspects where possible.

- Stay Informed on Innovation: Keep an eye on manufacturer innovations like cocoa-free or lab-grown chocolate. These could become viable alternatives in the future.

More Information: For a deeper dive into why candy prices are on the rise, check out this article: CNBC.

3. SNAP Under Threat: Preparing for Program Changes

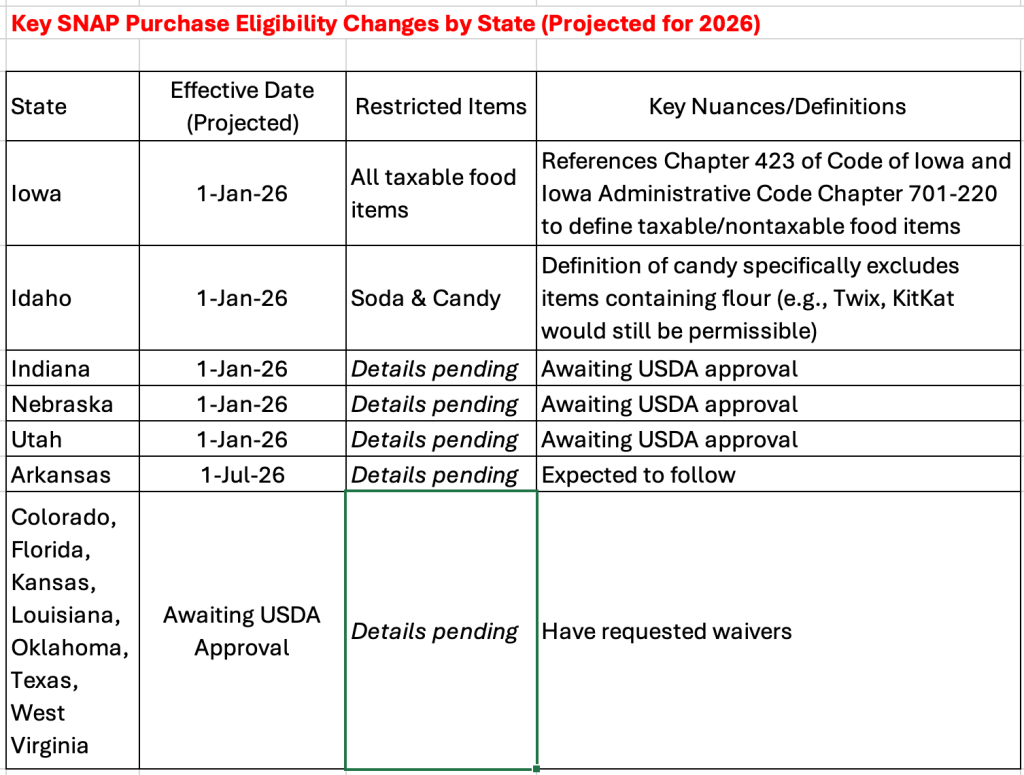

The Supplemental Nutrition Assistance Program (SNAP) is facing significant challenges as a growing number of states are requesting federal waivers from the U.S. Department of Agriculture (USDA) to restrict what benefits can be used to purchase. These restrictions specifically target items like soda, energy drinks, and candy. States like Iowa and Idaho have already had waivers approved, with restrictions planned to take effect in early 2026. For example, Iowa’s waiver prohibits purchases of “all taxable food items,” while Idaho plans to ban soda and candy, with a confusing caveat that allows flour-containing candies (like KitKat) but not others.

These definitions often rely on state tax codes, which were never intended for federal nutrition policy, making them notoriously complex and difficult for retailers to interpret at the point of sale. Beyond product restrictions, the SNAP redemption process is also evolving, with chip payment cards coming in early 2025 in some states.

Why it matters to C-store Owner/Operators: Implementing product-specific restrictions at the state level will require major point-of-sale (POS) system overhauls, complex compliance protocols, and extensive staff training. The cost and complexity could be enormous, potentially forcing some retailers to stop accepting SNAP altogether. SNAP is a crucial revenue stream for many C-stores, especially those in rural or underserved urban areas where they serve as vital food access points. Losing SNAP customers or reducing their eligible purchases will directly impact your sales.

The state-level waivers limiting SNAP purchases represent a significant fragmentation of the SNAP program, moving away from its historical national consistency. This fragmentation creates an unprecedented compliance challenge for multi-state C-store operators and even single-store owners trying to navigate complex, state-specific definitions. The reliance on state tax codes for defining eligible items, which were originally written for sales tax administration and not federal nutrition policy, highlights the arbitrary and difficult nature of compliance. This inherent complexity directly impacts operational efficiency, increases the risk of inadvertent non-compliance, and necessitates significant investment in technology and training.

Furthermore, the potential for C-stores to stop accepting SNAP due to the overwhelming compliance burden creates a significant social equity issue, particularly in rural and underserved urban areas where C-stores are often the only accessible food retail points. This could lead to the creation or exacerbation of food deserts and disproportionately affect vulnerable populations, undermining the very purpose of the SNAP program.

What You Should Be Doing:

- Assess Your SNAP Exposure: Understand what percentage of your sales come from SNAP and which specific products are frequently purchased with benefits.

- Engage with Your POS Provider: Proactively discuss the upcoming changes and understand what system upgrades or software patches will be required to handle product-specific restrictions and chip card processing. Don’t wait until the last minute.

- Intensive Staff Training: Develop clear, easy-to-understand training materials for your staff on the new SNAP rules, including how to identify eligible versus ineligible items and handle customer inquiries. Role-playing scenarios can be helpful.

- Monitor State-Specific Regulations: Stay updated on waiver requests and approvals in your operating states. NACS is actively advocating on this issue, so leverage their resources.

- Advocate: Consider joining industry associations like NACS to lend your voice to advocacy efforts against these burdensome restrictions. Policymakers need to understand the real-world operational impact.

- Diversify Offerings: While SNAP is vital, continue to expand your healthy and “staple food” offerings (fruits, vegetables, meat, dairy, bread, cereal) to cater to a broader customer base and reduce over-reliance on restricted categories.

More Information: Learn more about the threats to SNAP choice and their implications for retailers here: NACS.

4. The Protein Power Play: Fueling Customer Demand

The demand for protein-rich foods and snacks isn’t just a trend; it’s a full-blown “craze” that’s reshaping consumer purchasing habits. This is deeply tied to a broader “wellness era” where consumers are actively seeking healthier, functional, and nutrient-dense options. A significant portion of Americans (55% in a NACS survey) feel they should be eating healthier, and 53% are specifically focusing on increasing protein in their diet. The global protein snacks market alone is projected to more than double, from $4.1 billion in 2022 to $10 billion by 2032. This growth is fueled by the desire for sustained energy and satisfaction from on-the-go snacks.

This trend extends far beyond traditional protein bars to include a wide array of options: hard-boiled eggs, Greek and Icelandic yogurt, string cheese, cottage cheese, tuna packs, veggie sticks with hummus, and even plant-based alternatives like lentil chips and mushroom jerky. Major CPG companies like Conagra are already innovating, developing “GLP-1-friendly” and high-protein products.

Why it matters to C-store Owner/Operators: This is a massive growth opportunity that aligns perfectly with the evolving consumer landscape, including the impact of GLP-1 medications. By embracing this trend, you can attract a broader customer base, increase basket sizes, and build stronger loyalty. Offering “better-for-you options” allows you to move beyond the perception of “gas station fare” and position your store as a legitimate destination for convenient, healthy meals and snacks. The expansion of refrigerated sections and snack aisles to accommodate these preferences indicates that this isn’t just about adding a few items; it’s about a strategic re-evaluation of your product mix and store layout.

The demand for protein is not a standalone trend but is deeply intertwined with broader consumer wellness movements, including the rise of GLP-1 drugs. This creates a synergistic opportunity for C-stores to cater to a health-conscious demographic that is actively seeking functional foods, thereby expanding their market reach beyond traditional convenience shoppers. By focusing on protein, you’re not just adding a product; you are tapping into a fundamental change in consumer values, allowing you to attract new customer segments (e.g., health-conscious individuals, GLP-1 users) who might not traditionally frequent C-stores for their primary food needs.

The growth in protein demand extends beyond traditional protein bars to a wide array of fresh, refrigerated, and even plant-based options. This means that meeting this demand goes far beyond simply stocking more protein bars on dry shelves. It necessitates increased refrigerated space, potential investments in equipment for preparing fresh, made-to-order options, and a more sophisticated supply chain for perishable goods. This represents a significant operational shift, not just a merchandising adjustment.

What You Should Be Doing:

- Expand Your Protein Portfolio: Go beyond just protein bars. Stock a diverse range of protein-rich snacks and grab-and-go meal components. Examples include hard-boiled eggs, Greek yogurt cups, various cheese sticks, single-serve jerky, tuna/chicken salad packs, and pre-portioned nuts/seeds.

- Boost Your Refrigerated Section: Ensure you have ample, well-merchandised space for refrigerated protein items like yogurts, prepared salads with protein, and healthy wraps.

- Innovate Your Foodservice: If you have a foodservice program, integrate more grilled proteins, customizable bowls, and high-protein breakfast options (e.g., egg bites).

- Highlight “Clean Label” & Functional Foods: Consumers are looking for products with minimal ingredients and functional benefits. Emphasize these attributes in your signage and promotions.

- Consider Plant-Based Proteins: The plant-based snack market is growing rapidly. Explore options like lentil chips, chickpea puffs, and plant-based jerky to cater to a wider audience.

- Strategic Placement: Place protein-rich items prominently, perhaps near the beverage cooler or checkout, to capture impulse buys from health-conscious customers.

More Information: Discover more about the surging demand for protein and how it’s shaping the food industry here: CNBC.

5. K.I.S.S. Your Customers: Simplicity in Service

You’ve probably heard of the K.I.S.S. principle: “Keep It Simple, Stupid” (or “Keep it simple and straightforward”). It’s a design principle that applies perfectly to customer service, advocating that systems and processes should be as simple as possible to ensure maximum user acceptance and interaction. For quick-service environments like ours, this means prioritizing speed and efficiency above all else. Customers expect a quick, seamless experience, whether they’re grabbing coffee, filling up, or picking up a snack.

Applying KISS to customer service enhances problem-solving, improves operational efficiency, boosts customer experience, and even lifts employee morale. Key elements of simple, effective customer service include an upbeat greeting, solid listening and communication skills, the ability to solve problems and show concern (including apologizing when needed), and a genuine expression of appreciation at parting.

Why it matters to C-store Owner/Operators: Convenience is literally in our name! Any friction or complexity in the customer journey directly undermines your core value proposition and can drive customers to competitors. Simple, efficient, and friendly service leads to higher customer satisfaction, which directly translates to repeat business and stronger loyalty. Streamlined processes benefit your staff too, reducing errors, speeding up transactions, and improving overall store performance. This means less stress for your team and more productivity. In a crowded market, a consistently fast, friendly, and straightforward experience can be your strongest differentiator.

What You Should Be Doing:

- Streamline Checkout: Ensure your POS systems are fast and intuitive. Train staff to process transactions quickly and accurately. Consider mobile payment options to reduce friction.

- Optimize Store Layout: Design your store for quick navigation. Ensure aisles are clear, products are easy to find, and high-traffic areas are managed efficiently.

- Invest in Staff Training: Focus training on the “four skills” of KISS customer service: genuine greetings, active listening, efficient problem-solving (with empathy), and sincere appreciation.

- Standardize Operations: Implement clear checklists and Standard Operating Procedures (SOPs) for daily tasks, from opening to closing, cleaning, and stocking. This ensures consistency and reduces errors.

- Leverage Technology Wisely: Use technology to simplify, not complicate. Digital checklists, task management apps, and video insights can improve back-end efficiency, freeing up staff to focus on customer interactions.

- Solicit Feedback: Make it easy for customers to provide feedback (surveys, satisfaction buttons) to identify pain points and continuously improve your service.

More Information: Explore the importance of simplicity in customer service here: Restaurant Dive.

Bonus: Inviting Environments Encourage Longer Visits

While convenience stores traditionally focus on getting customers in and out quickly, a new trend is emerging from the grocery sector: using design to encourage customers to stay longer. This shift is driven by a desire to create a “sense of place” and provide an experience customers can connect with. Key elements include narrower aisles to foster interaction, added amenities like more seating, sushi counters, and even bars, and designs that connect indoor and outdoor dining areas. Some stores are even adopting neighborhood-specific designs and enhancing restrooms to provide a “royal treatment”. This approach acknowledges that despite the rise of online retail, consumers still value the in-person shopping experience.

Why it matters to C-store Owner/Operators: While your core mission is speed, there’s a growing understanding that a more inviting environment can enhance customer satisfaction and potentially increase basket size, especially if you’re expanding into foodservice or higher-margin prepared foods. Creating a pleasant atmosphere can make your store a more attractive destination, encouraging customers to linger, discover new products, and spend more. This can lead to increased dwell time and customer satisfaction, directly benefiting your sales. In a competitive landscape, store image and ambiance can become powerful differentiators.

What You Should Be Doing:

- Enhance Ambiance: Focus on creating a bright, clean, and welcoming atmosphere. Pay attention to lighting, store layout, and overall cleanliness.

- Consider Seating Areas: If space allows, even a small, comfortable seating area can encourage customers to enjoy prepared foods or beverages on-site, increasing dwell time.

- Improve Restrooms: Clean, well-maintained, and appealing restrooms significantly impact customer perception and satisfaction.

- Strategic Design Elements: Think about how your exterior design attracts customers. Use eye-catching signage, ensure good lighting, and consider local art or community collaborations to make your store stand out.

- Optimize Product Placement for Discovery: While maintaining efficiency, consider how a more inviting layout might encourage customers to explore new categories, particularly in foodservice or healthier options.

- Gather Feedback on Environment: Use surveys or direct observation to understand how customers perceive your store’s environment and identify areas for improvement.

More Information: You can read more about how grocery stores are using design to encourage longer visits here: Costar.

The Bottom Line

What a busy day for news, right? From the seismic shifts driven by GLP-1 medications and the rising costs of our beloved candy to the critical changes ahead for SNAP and the ever-present need for simple, efficient service, it’s clear our industry is dynamic. And let’s not forget the subtle but powerful impact of creating an inviting store environment.

The common thread running through all these headlines is adaptation. The convenience store of tomorrow won’t look exactly like the convenience store of today. It will be a place that caters to evolving health consciousness, navigates complex regulatory landscapes, and continues to prioritize speed and efficiency while also offering a more welcoming, purposeful experience. By understanding these trends and proactively implementing the suggested actions, you’re not just reacting to change; you’re shaping the future of your business and ensuring your store remains a vital, profitable hub for your community. Keep learning, keep adapting, and keep those doors open!

Leave a comment