Part 1: The Health-Conscious Customer: An Untapped Gold Mine Hiding in Plain Sight

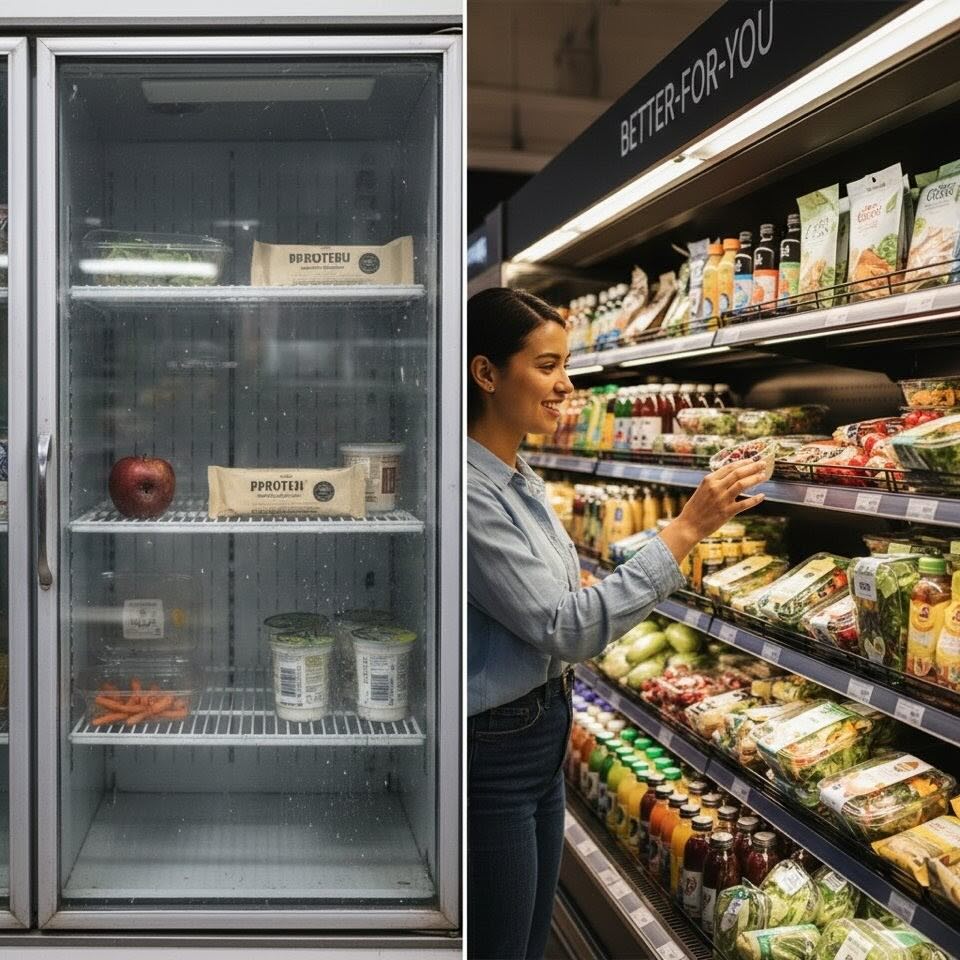

Walk into any convenience store and the story is the same: sugary drinks, salty snacks, and hot dogs spinning on a roller grill. For decades, the industry’s business model has been built on the assumption that what customers want is simple: quick, easy, and cheap. The thinking has always been that convenience is king, and any notion of health is an afterthought. But for today’s c-store owner-operator, this outdated assumption is costing you a massive, untapped revenue stream. The truth is, your customers are already looking for healthy options, they just aren’t finding them in your store.

This isn’t a minor trend; it’s a monumental shift in consumer behavior. A recent study reveals that a significant portion of convenience store shoppers, roughly six out of ten, identify as health-conscious. Think about that for a moment. That’s a majority of the people walking through your doors every single day. This demographic includes busy millennials grabbing a quick lunch, parents looking for a nutritious snack for their kids, and fitness enthusiasts needing a protein boost on the go. Despite their personal intentions, these customers are not turning to convenience stores to buy healthy and “Better-For-You” (BFY) products.

The Disconnect: A Chasm of Opportunity

The data reveals a startling disconnect between what customers want and what they are currently offered. When asked about their satisfaction with the current healthy food and beverage selection, a staggering 65% of your most promising customers reported being actively dissatisfied. This isn’t just a missed opportunity; it’s a chasm. The demand is already there, and the customer base is actively looking for a solution. An owner-operator with a well-thought-out BFY strategy will fill this void. They stand to capture a huge slice of their competitor’s business.

The real eye-opener is where these customers are spending their BFY dollars instead. The data shows that most healthy purchases by these consumers happen at traditional grocery stores. They also occur at mass retailers.

The BFY Market: Where C-Stores Are Falling Behind

- Mass Retailers: 55%

- Traditional Grocery: 48%

- Club Stores: 36%

- Dollar Stores: 36%

- Convenience Stores: 32%

This points to a deeper pattern of behavior. For consumers, a c-store is a place of last resort for a quick, unhealthy bite, not a first choice for a wholesome meal or snack. They simply don’t see your store as a primary destination for health-oriented purchases. This is a powerful perception that can be changed.

The Bottom Line: The Path Forward

The goal of a smart BFY strategy is to change this perception, shifting your store from a “last-stop” to a “first-choice” destination. Imagine your customers walking in and seeing not just a roller grill, but a fresh salad bar. Not just a soda fountain, but a grab-and-go cooler filled with cold-pressed juices and kombucha.

You already have the foot traffic. Your customers are already in your store. The challenge—and the opportunity—is to give them a compelling reason to make a healthy purchase. The demand is there, and the market is wide open for the c-store that gets it right.

This is just the beginning. The tactical blueprint for achieving this will be detailed in the following posts. In Part 2 of The C-Store Playbook, we’ll explore the specific actions you can take. These actions will help you identify and stock the right BFY products for your unique store and community. Stay tuned!

Leave a comment